Why a Paraguay permanent residency visa is more attractive than a permanent residency visa for Panama

The most popular countries in the region to date include Mexico, Belize and Panama. The latter is particularly appealing for most expatriates, with a reputation for favourable dual residency conditions and taxation regime. An alternative, and something of a hidden gem in the region, however, is Paraguay – an unassuming, landlocked country in the centre of the South American landmass. More and more people are discovering how beneficial, and easy, it is to acquire permanent residency in this small but up-and-coming nation. In this article, we’ll explore some of the reasons why a Paraguay permanent residency visa is more attractive than a permanent residency visa for Panama.

The application process

Before you even set foot in either country, the ease in applying for residency in Paraguay is self-evidently greater than in Panama. And once you are officially a dual resident, this status is easier to maintain in Paraguay, which has some of the most relaxed residency laws of any country in the world.

The official immigration process to obtain the Paraguay Permanent Residence Permit takes less than three months. What’s more, permanent resident status can be maintained without the requirement of one’s physical presence in Paraguay for all or part of the process. Foreigners who succeed in their application for dual residency can choose to live in Paraguay full-time or part-time, or live somewhere else altogether, all while retaining dual residency rights. This is practically unheard of in other countries, including Panama.

Once you are a permanent resident, you will be legally allowed to live and work in Paraguay – or in your home country, should you prefer – for life, and will only lose this status in extreme cases of wrongdoing. In this respect Paraguay differs greatly from most countries, where permanent residency comes up for renewal on a regular basis. You will be able to benefit from Paraguay’s excellent education and healthcare systems, as well as its rich cultural heritage, for life. The country is also well-known for granting a great deal of personal freedom to its residents, who truly can live the life they want, within reason! Dual residency also opens the door to South America’s Mercosur region, and attractive markets and tourist destinations like Brazil and Argentina, at no extra cost or inconvenience.

In Panama, on the other hand, the process for obtaining legal dual residency is much more complicated. It involves either having a pension or making an investment large enough to be considered for temporary residency, which can be converted later to permanent legal residency. The largest obstacle for foreigners is the exorbitant cost involved, which we will cover below.

The cost of dual residency

In Paraguay, the process of obtaining residency can be initiated by making a bank deposit of $5,000 USD, after which no minimum income requirement need be met. The other option is to purchase local real estate. After three years as a permanent resident, you can apply for naturalization and full Paraguayan citizenship.

In Panama, things are different, and much more expensive. The most standard path towards residency is the Panama Friendly Nation Visa. Citizens from one of 50 “Panama-friendly” nations around the world can apply for permanent residency if they wish to “relocate to Panama in order to conduct economic or professional business activities”. The requirements were relatively accessible for most foreigners until August 2021, when the financial conditions for application rose sharply.

As it stands, in order to qualify for the programme, applicants will need to either obtain salaried employment with a Panamanian company, with a corresponding work permit, or purchase real estate in the country worth at least $200,000. Successful applicants will obtain a 2-year temporary resident visa, and will only be able to apply for permanent resident status once this 2-year period has elapsed. Again, you will need to be able to offer proof of employment or a sizeable real estate investment at this point.

Other visa programme options for foreigners, such as the Panama Self Economic Solvency Visa, Panama Business Investor Visa, Panama Reforestation Investor Visa, Panama Retired or Pensioned Program or Qualified Investor Program, all require six-figure investments in the Panamanian economy. The only other viable route to permanent residency is a legal and valid marriage to a Panamanian citizen, which is easier said than done! For most outsiders shopping around for a new start in Latin America, there really is no comparison between Paraguay and Panama in terms of the financial requirements for permanent residency.

Cost of living

The differences between the tax systems in Paraguay and Panama are not as clear-cut, but they should still be considered by anyone considering relocating to one country or the other. Paraguay only places a tax on income and personal gains earned in the country itself – a flat rate of 10%. Income earned outside the country is not taxed at all, which is a bonus for foreigners with business interests elsewhere. Furthermore, there is no inheritance or estate tax in Paraguay, no net worth tax, and no capital duty, stamp duty or capital acquisitions tax

In Panama, individuals – including dual residents – are only subject to tax on income in Panama, and not foreign-source income. This income tax is applied to all residents, at progressive rates on their taxable income. Taxable net income up to PAB 11,000 is exempt from income tax, while taxable net income between PAB 11,001 and PAB 50,000 is subject to a tax rate of 15%. Taxable net income over PAB 50,000 is subject to a tax rate of 25%.

Would-be dual residents who are concerned about their finances should be aware that the cost of living in Paraguay is nearly half the equivalent cost of living in Panama. And the disparity in rent is even greater between the two: compare the average cost of renting a one-bedroom apartment in the centre of Paraguay’s capital city, Asunción ($246.55 USD) with the average cost of renting a one-bedroom apartment in Panama City center ($722.37 USD). Education costs are far higher in Panama too, which may explain why international students are more likely to flock to Paraguay and its relatively inexpensive universities. Given this sizeable difference in living costs, one can only imagine how high one’s quality of living could be with a permanent residency in Paraguay, compared to pursuing a similar status in Panama.

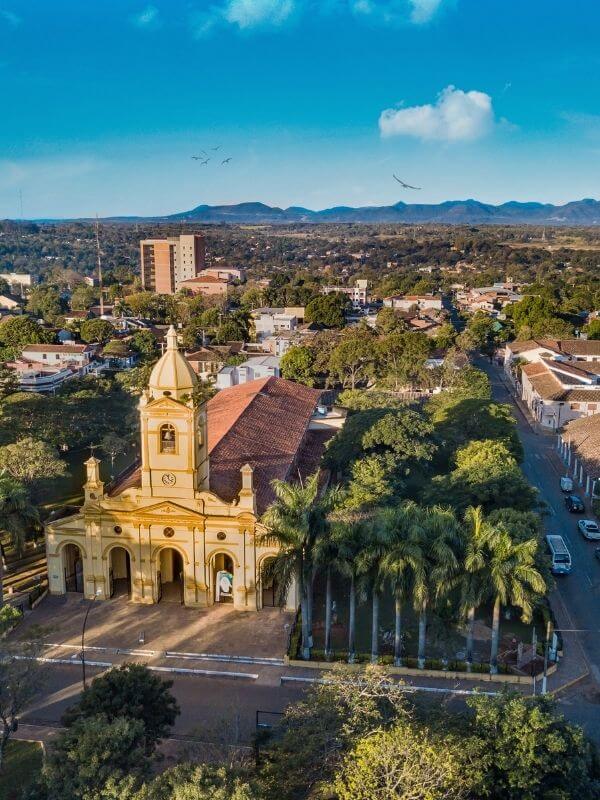

Finally, all rules and regulations aside, Paraguay is an excellent place to live, blessed with beautiful scenery, peaceful countryside, and enviable education and healthcare systems. The country’s subtropical climate sees warm winds blow in from the Amazon Basin in the summer months, during which time residents can take advantage of the natural beauty on offer, from stunning lakes to breathtaking waterfalls. Panama, meanwhile, has a tropical climate marked by high temperatures and humidity, with up to 118 inches of rainfall every year, and a wet season which runs from April to September. The humidity can be off-putting to some, as can the lack of variation in temperature, due to the country’s close proximity to the equator.

As you can see, if you are looking for a new start for yourself, your family or your business in an exciting new Latin American country, there are many compelling reasons to seek dual residency in Paraguay, especially compared to the more well-known Panama. For a start, the price of entry is significantly smaller in Paraguay, as are typical living costs. Much greater ease of access, combined with a relatively straightforward application process which can easily lead to full citizenship and does not even require one’s physical presence in the country, all make Paraguay the more attractive option for the average outsider. However, each case is different, and we would recommend reaching out to a specialised agency to discuss the best move for you, before making any concrete decisions. Get in touch with Strategicasa today to find out more!